European Business Angels Network is the pan-European representative for the early stage investor community gathering over 100 member organizations in more than 50 countries today. Established in 1999 by a group of pioneer angel networks in Europe with the collaboration of the European Commission and EURADA, EBAN represents a sector estimated to invest 11.4 billion Euros a year and playing a vital role in Europe’s future, notably in the funding of SMEs. EBAN fuels Europe’s growth through the creation of wealth and jobs.

EBAN’s Mission

Driving successful and responsible Angel Investing in Europe

EBAN’s Vision

The European Voice of Angel Investing

EBAN’s Values

1. Integrety

Maintain transparacy and high ethical Standards

3. Impactful

Make measurable positive impacts on society and environment (UN SDGs and PRI), along side financial return

5. Diversity

Promote diversity within the investment and entrepreneurship ecosystem

2. Excellence

Strive for excellence and be quality driven

4. Leadership

Be the source of inspirational leadership

6. Celebrate

Recognize and celebrate the entrepreneurship and early- stage investment heroes in our community

EBAN member categories

EBAN’s Pillars of Activity

Connecting the early stage ecosystem, sharing knowlegde and best practices

Work with Us

For Investors

EBAN is Europe’s leading early-stage investor network. We connect and support business angels, early stage investors, entrepreneurs and corporates throughout the world.

For Entrepreneurs

EBAN organises two flagship events every year, along with several smaller scale events, which offer entrepreneurs unequalled access to investors, startup coaches and support agencies that can help them scale their business.

For Partners

EBAN is committed to supporting the development of a strong European early stage investment ecosystem and partners with various private, governmental and investor/startup organisations to achieve this goal.

Angel Investing Explained

Angel Investment: (High-risk) investments made by private early stage investors typically in the form of seed financing towards startup businesses. Angel investment comprises financial contribution in addition to the investment of time, expertise and connections that the investors also provide in exchange for ownership equity in the startups.

Business Angel: Private investors who choose to make seed and early-stage investments into startup companies. Besides investing their capital, business angels also support their investee companies with mentoring and advice, expertise and network connections. Business angels are also commonly referred to as angels or angel investors.

What Angels Provide

EQUITY

MENTORSHIP

NETWORK

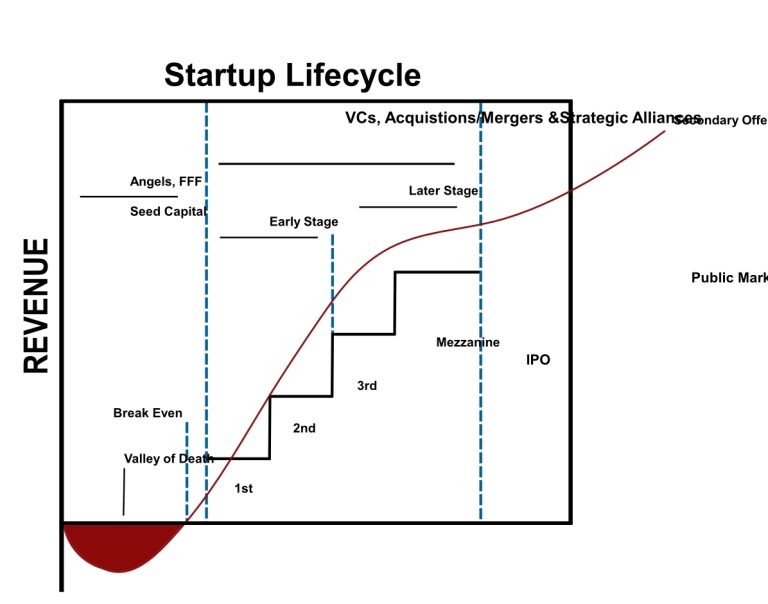

A business angel investment is normally a minority investment (usually 10-30%), and it is directed at the pre-seed, seed or early stage & startup phase. Angels are increasingly investing in syndicates and alongside seed venture capital funds. Correspondingly, venture capitalists mainly make later stage minority investments (venture investments) or expansion majority investments (buy-outs):

Angels provide both financing and managerial experience, which increases the likelihood of startup enterprises surviving the “valley of death”. Statistics show the impact of angel investment on employment; ventures funded by angel investors have proven to be more successful than those that have been rejected, as evidenced by their survival rates and the evolution of their employment. Given the importance of early stage investors like angels for the creation and maintenance of an entrepreneurial economy, fostering their investment has a significant leverage effect on job and wealth creation.

Angels play an important role in the economy, and in many countries, constitute the largest source of external funding in newly established ventures, after family and friends. They are increasingly important in providing risk capital as well as contributing to economic growth and technological advances. Moreover, the supply of startup and early-stage equity finance has to some extent become more dependent on angels, as venture capital funds are not able to accommodate a large number of small deals. The traditional source of startup and early-stage financing – bank lending – is limited due to risk level and handling cost.

Angels are a rising movement, present in every single European country, and EBAN keeps on working to advance their development in all countries.

To learn more about angel investing, check out our Knowlegde Center